Fluid DEX Lite

Introducing Fluid DEX Lite, a minimalistic, most gas-efficient DEX focused on handling small swaps on Ethereum. DEX Lite will be the first credit-based protocol on top of Fluid. Expected date of going live in 7-10 days upon governance approval.

Context

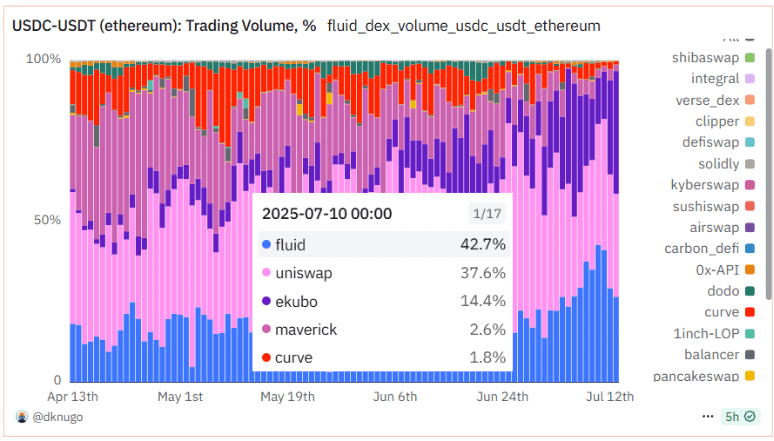

Fluid DEX is a dominant player on the market of correlated pairs, becoming the 2nd biggest DEX on Ethereum within 3 months of going live, and it has significantly increased its share in the past few weeks.

However, in recent times, due to decreasing fees to an absolute minimum (0.0005% on USDC-USDT), a significant portion of swap volume on Ethereum is driven by Sandwich attacks, which generate up to 200x in volume per x of real DEX volume.

An example of a Sandwich worth $1.56M below, which happened on a $7.74k swap on Ekubo. Similar kinds of sandwich attacks also happen on all other DEXes (including Fluid). However, the volume multiplier (“x” factor) of sandwich attacks decreases as swap size increases. On Fluid, these may be closer to 20x versus 200x on smaller trades.

Every trade sent to a public meme pool is at risk of a sandwich attack. So if a DEX can route more trades (doesn’t matter the size), it can get more volumes from sandwich attacks. A small, highly gas-efficient DEX routing a lot of smaller organic trades (in the 4-digit range) can do a higher volume due to sandwich attack than a DEX with deeper liquidity routing less of larger organic trades (in the 6-digit range).

These small trades are extremely sensitive to gas costs on Ethereum. While Fluid DEX’s architecture is more sophisticated than its peers, this also makes it around 25% more gas-intensive than Uniswap v3, meaning Fluid misses out on sandwich-driven volumes from smaller trades.

Example:

In multi-hop swaps, slippage applies to the full route. A 0.05% slippage tolerance allows each hop to be manipulated by that amount.

Assume a user swaps 1000 ETH to USDT via:

- Hop 1: ETH → USDC (0.05% fee pool)

- Hop 2: USDC → USDT (0.0005% fee pool)

An attacker sees this in the mempool and profits by manipulating the second hop:

- Front-run: Attacker buys USDT with USDC, increasing the price.

- Victim’s trade: Executes at worse rates due to higher USDT price, but still within slippage tolerance.

- Back-run: Attacker sells USDT back to USDC at a profit.

This profit comes directly from the slippage the user was willing to tolerate.

Fluid DEX Lite Features

- Most gas-efficient DEX on Ethereum: Swap logic uses ~10,000 gas (vs. ~24,000 for the current best-in-class).

- Replicates Fluid DEX v1 logic: With major gas optimizations.

- Singleton architecture: Supports multiple pools and the most gas-efficient routing between them.

- Expected to drive $200M in daily average volume through increased small-trade routing.

- Launching with only the USDT-USDC pool, new pools can be created upon governance approval.

Fluid DEX Lite prioritizes gas efficiency over capital efficiency and introduces the foundation for a credit layer on Fluid, making it the first protocol to allow borrowing directly from the Fluid Liquidity Layer. The first Fluid DEX Lite pool will be USDC-USDT and will expand to other pools in the near future.

Key benefits:

- USDC-USDT pool is bootstrapped via a credit line, generating fees for the protocol instead of spending treasury for incentives.

- Borrowing fees go to the Fluid Lending Market, increasing fee generation for Fluid.

- Additional swap fees flow directly to the DAO treasury.

- Estimated APR is up to 10%.

In case the protocol takes any losses, the team will cover them from its own funds.

Proposal

This proposal recommends integrating Fluid DEX Lite into the broader Fluid ecosystem, as follows:

- Launch Fluid DEX Lite optimized for gas efficiency.

- Provide a $5M USDC/USDT credit line to Fluid DEX Lite protocol. Team multisig will be the sole operator of the protocol.

- 100% fees generated will go to DAO as an extra source of revenue.

All pool parameters (fee, range, etc.) will be managed by the team based on market conditions.

Conclusion

Fluid DEX Lite represents a strategic expansion of the Fluid protocol, which will allow for capturing more volumes, generating more fees through borrowing and swap fees, and building the foundation for credit-based protocols built on top of Fluid.