Some questions:

-

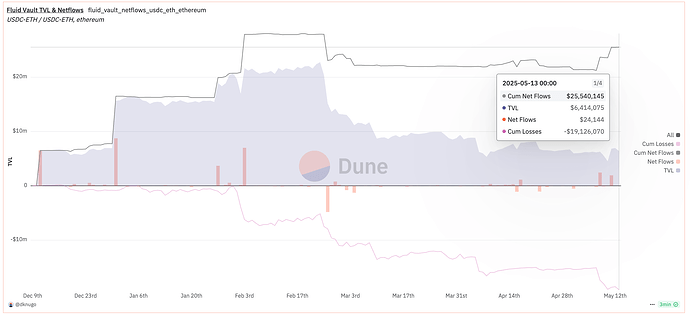

What’s the math behind compensation amount? 500,000 FLUID is approx $2.6M at current price. Cumulative losses in this pool were ~$19M since launch (see chart). Ofc not everything should be considered as “losses”: ETH price is still below ATH, some people were leveraging recklessly and were rightfully liquidated, etc. But still the difference is pretty high

Source: https://dune.com/queries/4855794/8043079 -

How $400k/month future compensation was calculated? Do you expect that LPs will incur ~$400k rebalancing losses next 2-3 months (till DEX v2 launch) at current pool TVL?

As for pool range it’s hard to make any decisions without extensive (back)testing. I’m sure the team made some backtests before launch and expected that LPs will be in profit. Then volatility rised significantly and LPs were rekt. The question is: was the previous approach to backtesting correct or were there any flaws in backtest algo that didn’t take into account some significant factors?