Context

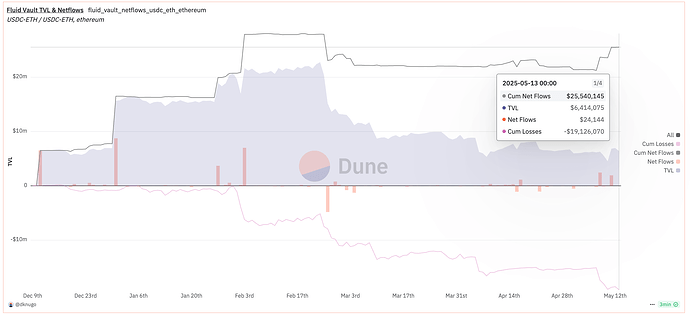

Over the past few months, our ETH-USDC DEX pool has established itself as a market leader in both trading volume and fees generated. However, during periods of sharp volatility, the current v1 design triggers rebalancing which incurs losses to LPs.

Description

The ETH-USDC pool launched in late December with ETH at ~$4,000. Since then, ETH has experienced the most extreme volatility of the past two years — dropping to $1,400 and now trading around $2,600. Note: The fee generated on Fluid’s ETH-USDC per liquidity depth is similar to Uniswap’s ETH-USDC 0.05% pool.

While the pool performs exceptionally well when prices stay within range (accruing strong fees for LPs), high volatility triggers rebalancing. This happens gradually through trades routed via the pool — from ~$3,800 to ~$1,560, and now ~$2,340. The rebalancing mechanism incurs realized losses for LPs that outweighed fee income.

We believe the pool can perform very well in a more stable environment — it just hasn’t had the chance to prove it yet.

Perfect Solution

DEX v2, launching in June–July, designed specifically for:

- Sophisticated Liquidity Providers

- Dynamic LP strategies

- Better performance under all market conditions

- Dynamic fees

Quick fix

- Vest 500,000 of FLUID token (0.5% supply) for a year to affected users of ETH-USDC DEX.

- LPs who continue to provide liquidity will receive $400k $Fluid rewards per month until DEX v2 is live.

- Updating the range of pool.

Update range

Current range is 30% wide (-+15%) where rebalancing starts to happen when price goes out of -+10% range.

Rebalancing path in current pool since December:

- Launch at ~$3800

- Bottom point: ~$1560 (~59% down rebalanced from 3800)

- Current ~$2340 (~50% up from bottom) (12th May)

Scenario: Increasing range

Doubling the range to 60% wide (-+30%) where rebalancing will start to happen when price goes out of -+25% range.

Pros: Lower rebalancing hence less rebalancing related loss.

Fees: Half the fees per liquidity

Rebalancing path simulation:

- Launch at ~$3800

- Bottom point: ~$1866 (~51% down rebalanced from 3800)

- Current ~$1950 (~4.5% up from bottom)

Rebalancing related losses will vaguely be half w.r.t to current pool and fees earned will be half as well.

Scenario: Decreasing range

Halving the range to 15% wide (-+7.5%) where rebalancing will start to happen when price goes out of -+5% range.

Pros: Higher rebalancing hence more rebalancing related loss.

Fees: Double the fees per liquidity

Rebalancing path simulation:

- Launch at ~$3800

- Bottom point: ~$1474 (~61.2% down rebalanced from 3800)

- Current ~$2470 (~67.6% up from bottom)

(Note: there will also be point with this where pool can have minor rebalances in up & down due to range being thin)

While rebalancing related losses will increase by around 20-30%, the fees earned per liquidity will increase by 100%.

Team’s preference

Team’s preference is to decrease the range to 15% doubling the fees which increases the rebalancing related losses by 20-30%. Team is also running some simulations which we will post soon and can take the final decision.

$FLUID

Currently, treasury holds ~30% of the $FLUID token supply. $FLUID’s current emission rates is around 0.2% monthly going to lending incentives of USDC & USDT. The Lending protocol is the only place where DAO distribute rewards. Currently $FLUID emission & governance revenue is almost at par - whereas emissions are static, revenue is going up every month to a state where protocol is set to become highly profitable in this bull run. So in general 0.5% FLUID vesting emission is something governance should be able to afford.

DEX v2 will make volatile pairs on Fluid very lucrative while in the meantime distributing rewards and experimenting on existing ETH-USDC pool can be highly beneficial to Fluid if the pool turned out to be highly profitable. This can exponentially increase Fluid revenue while allowing Fluid to lead the DEX market so much so that Fluid can become the biggest DEX in the industry. At the same time, user’s entering the pool should be cautious of the risks and understand that pool is still going through some experimentation.

Misc

- Currently, we have kept BTC-USD pool on hold. While that pool is less risky & can be profitable due to high stability of BTC. We will plan to launch more volatile pools with DEX v2.

- Most CEX-DEX arbitrageurs (Wintermute, SCP, etc) went live on Fluid by the end of March which contributes to 50% of volumes on ETH-USDC pool. Hence, before March the pool has lost on quite a bit potential volume and fee related to it.

- The issue is only related to ETH-USDC pool. All other DEX pools have been working perfectly fine and are super profitable for users.

We’re fully committed to transparency and long-term value. We’re excited to share more details on v2 soon.